rsu tax rate india

5 hours agoSome of the very important points that a seller of property must know with respect to capital gains tax are. Tax Implications of Restricted Stock.

10 percent surcharge is applicable if annual taxable income is between.

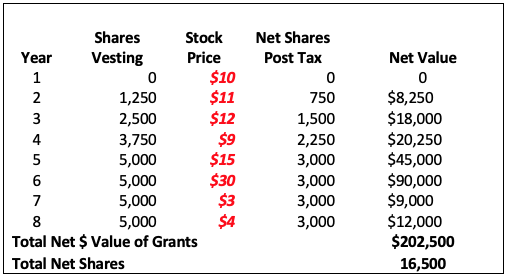

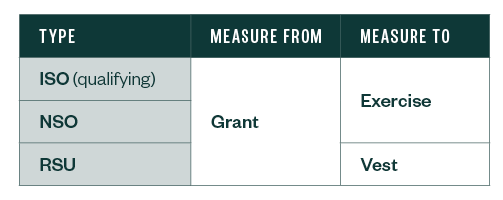

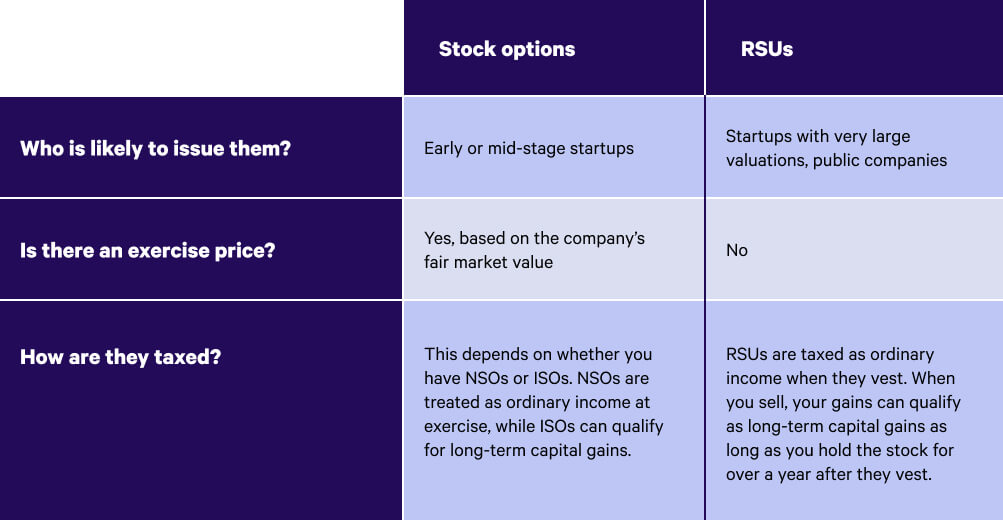

. This is different from incentive stock. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Listed below are some of the benefits of restricted stock units you need to consider.

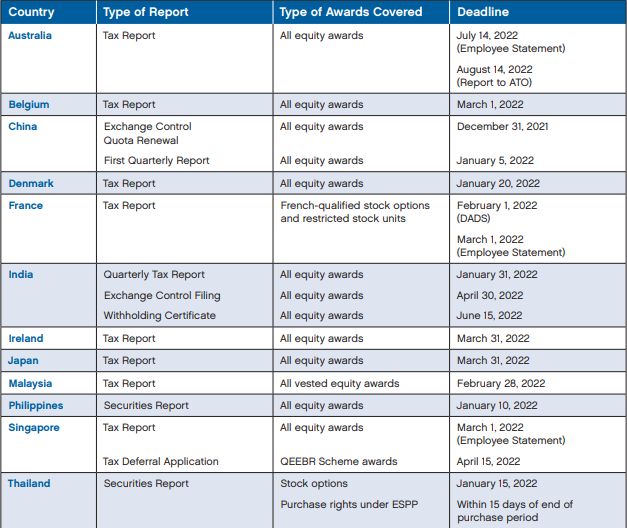

How is tax calculated for RSUs awarded by MNCs outside India. Answer 1 of 3. The nature of the gains will.

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. If you live in a state where you need to pay state. On etrade we have option to sell only ESPP or only RSU.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. If population exceeds 10 lakhs but up to 25 lakhs. Tax Rates for Long term Capital Gains.

RSUs offer several benefits to a companys employer and employees. The capital gains tax rate when you. Taxability on acquiring ownership.

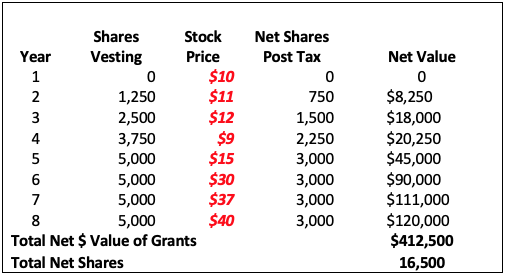

Many employees receive restricted stock units RSUs as a part of. RSU Taxes - A tech employees guide to tax on restricted stock units. Carol nachbaur april 29 2022.

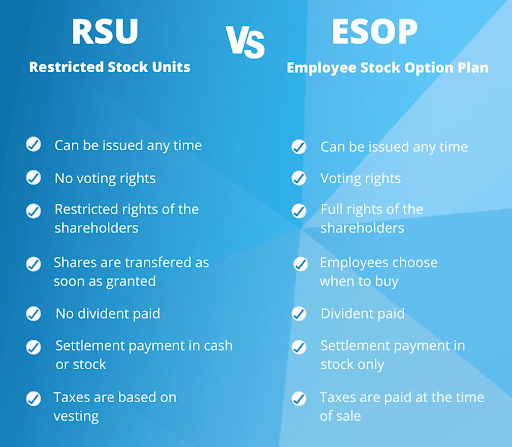

Restricted stock and RSUs are taxed as wages upon delivery and subject to progressive income tax up to approximately 57 percent. RSU Restricted Stock UnitsESOP. The gain from the sale of.

How Are Restricted Stock Units RSUs Taxed. Restricted stock is a stock typically given to an executive of a company. How it works in Google MicrosoftAdobeAmazon Walmart and what will be effective tax on allocated RSUs.

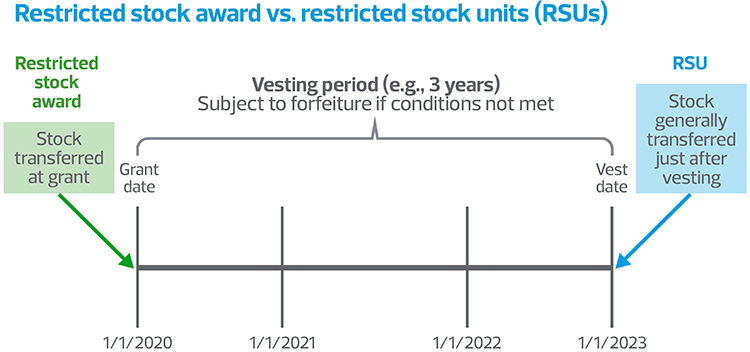

The stock is restricted because it is subject to certain conditions. Applicable Tax Rates. For LTCG on the sale of equity sharesunits of equity-oriented funds listed on recognised stock exchanges in India the applicable tax rate.

Since the ownership of these valuable shares comes free of cost or at a nominal price it is a considered as an employment perk or a. Also restricted stock units are subject. Hello Generally there is no double taxation since US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes.

When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money it is their duty to pay tax on that amount in India. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Carol Nachbaur April 29 2022.

RSU or Restricted Stocks units are very simple to understand. The Company gives company Stock to an employee without any. For one a recipient cannot sell or.

The tax rates vary depending on whether the shares are a listedan unlisted company. For senior citizens the. What are the taxation rules for RSUs in India.

Rsu Taxes Explained 4 Tax Strategies For 2022

:max_bytes(150000):strip_icc()/thinkstockphotos-aa000745-5bfc3467c9e77c0026320847.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Rsu And Taxes Restricted Stock Tax Implications

What To Do With All Those Rsus Claro Advisors Llc Claro Advisors Llc

How State Residency Affects Deferred Compensation

What To Do With All Those Rsus Claro Advisors Llc Claro Advisors Llc

All About Rsus Shares Taxes Applicable What Happens After 4 Years Truth Behind Rsus Youtube

Rsus Vs Stock Options What S The Difference Wealthfront

Must Knows About Restricted Stock Morningstar

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Restricted Stock Units Rsus Facts

Frequently Asked Questions About Restricted Stock Units

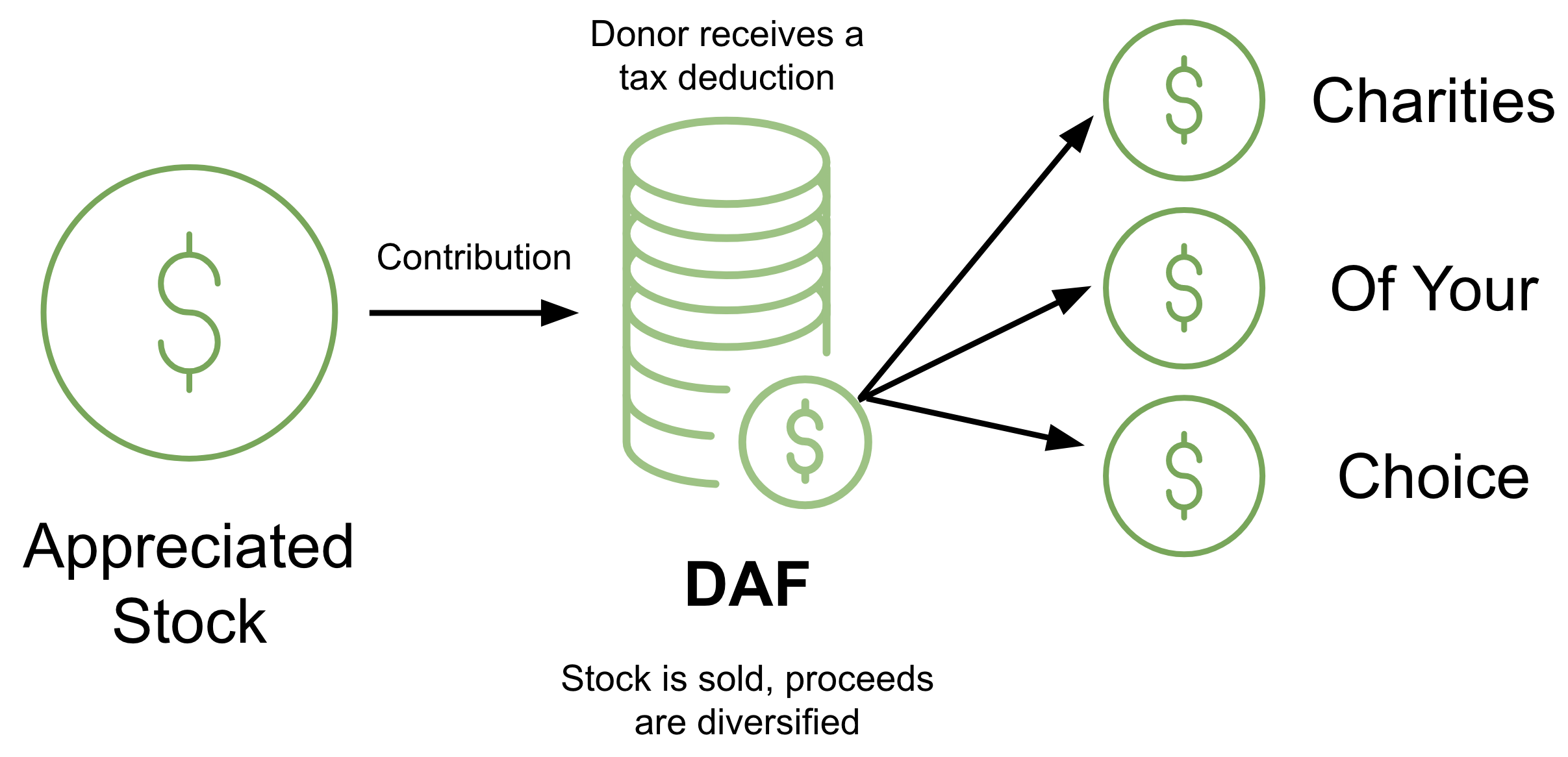

How To Avoid Taxes On Rsus Equity Ftw

Restricted Stock Units Rsu Meaning Taxation How It Works Blog By Tickertape

Income Tax Implications On Rsus Or Espps

Restricted Stock Units Rsus Merriman

What Are The Differences Between Esop Rsu And Phantom Stocks

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog